The last surplus for the federal government was in 2001.

U. S. Treasury Fiscal Data

The above grabbed my attention when it popped into my newsfeed. I’ve thought for a while that I would vote for [just about] any candidate who promised a balanced budget. I have to balance my budget at home. I have to balance my budget at work. I understand how financial efficiency can be gained through modest debt, but our Nation’s current trajectory seems unsustainable to me.

To help develop a more informed opinion, I applied Eli Goldratt’s throughput accounting. This method forces an organization to identify its overarching goal (sales, homeless fed, malaria reduction, etc.) while minimizing investments (things one can eventually sell) and operating costs (things one cannot).

I view the Declaration of Independence’s pursuit of life, liberty, and happiness as our Nation’s throughput. However, being a research team of one, the best data I could find was aligned with the Preamble of the Constitution and did not delineate investments from operating expenses. There is also 2.5% in “General Government” overhead that could not be allocated within one function so clearly, I’m making some pretty large assumptions.

LIFE

According to Harvard, life expectancy in the United States has generally been on the rise since 1900 but declined from 79 in 2019 to just over 76 in 2021. COVID-19 was a big driver, but so were drug overdoses and accidental injuries. More alarming is the unequal distribution, with southern states and non-whites having lost up to six years since 2019.

According to USAFacts, we expend 23% of our federal, state, and local dollars toward activities that improve life expectancy. I would argue we should spend more, but then again, I also think our current medical system inefficiencies stem from overreliance on insurance companies and the removal of pharmacists from the treatment lan.

LIBERTY

According to the Cato Institute’s Human Freedom Index, the United States dropped from a high of eighth globally in 2008 to 23rd in 2022. The study points to the rise of crony capitalism as our largest contributor, but also notes that ongoing wars on drugs, terrorism, and nation-states is reducing freedom globally.

According to USAFacts, we as a Nation expend 67% on liberty-related actives. That seems high and makes me think we should evaluate new approaches to reverse the trend.

HAPPINESS

Finally, some good news: we have risen one spot to 15th happiest country in the World Happiness Report! Unfortunately, this is only because we fell more slowly in absolute terms than the rest of the world, from just over 6.9 out of 10 to just below. The authors of all three indices noted a worldwide decline in absolute scores since the mid-2000s.

According to USAFacts, we expend 7.5% on happiness. That seems low and yet, somehow relatively working.

DEBT

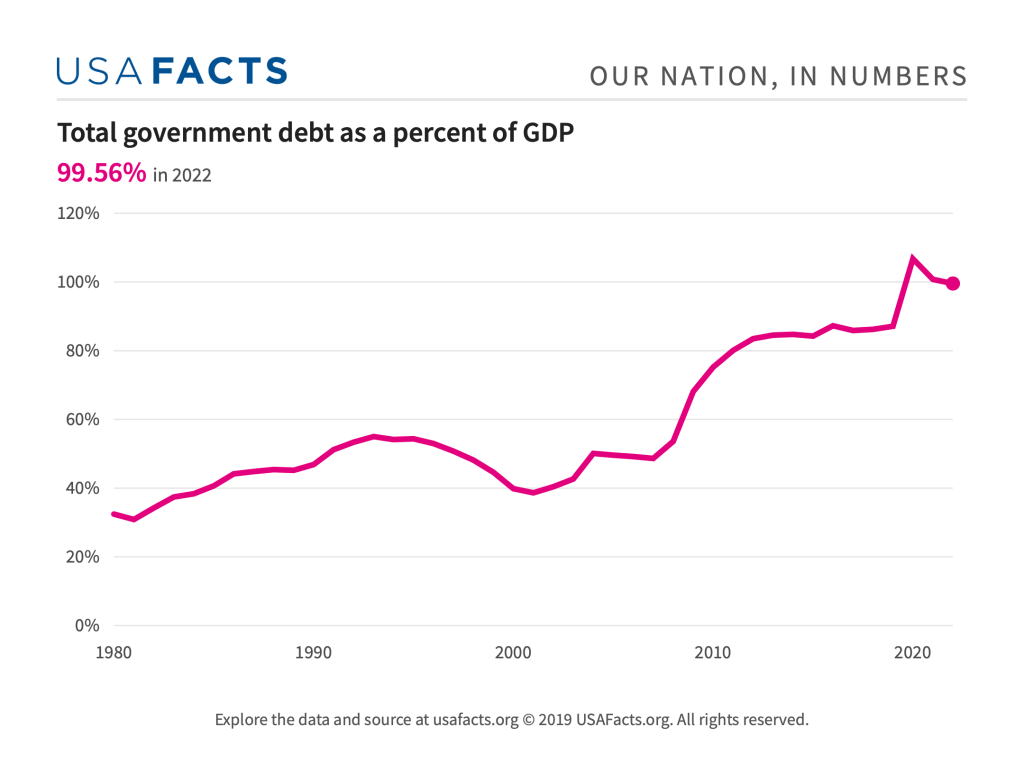

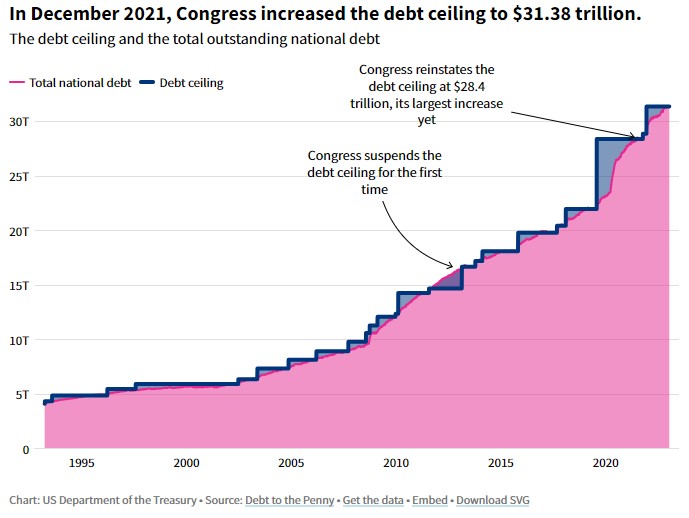

Now to the heart of the matter: our National revenue is 88% tax, 12% non-tax, and 10% deficit spending. Deficits have accumulated over time to a level of debt that is approximately equal to our annual gross domestic product (GDP). As my financial advisor reminds me, debt payments direct funds away from other important areas and increasing levels of leverage reduce financial freedom.

The United States has carried debt and relied upon foreign investors since its inception. The Revolutionary War resulted in $75 million in debt with a significant portion owned by France. Our current national debt is $32.66 trillion and costs $530 billion annually to maintain. Rising interest rates affect not only consumers, but also what we pay to the major owners of United States debt: Japan, China, the United Kingdom, Belgium, and Luxembourg. These countries will not [easily] seize U.S. assets should we default, but we can certainly expect hyperinflation and decreased world standing.

SO NOW WHAT?

My hypothesis is that we are putting more into the “life, liberty, and pursuit of happiness system” than we are getting out. Compounding the matter is that we are accruing unsustainable debt through deficit spending to do so. We now need to apply Eli Goldratt’s five focusing steps to improve throughput while minimizing investments and operating costs:

- Identify the system’s constraints: Article I, Section 8 of the Constitution assigns Congress the “power of the purse” and given Fitch’s recent downgrade of U.S. debt due to “political disfunction,” I will call our collective legislative body the United States’ throughput constraint.

- Decide how to exploit the system’s constraints: I guarantee there are imbedded constraints to advancing our Nation’s throughput. However, deficit spending avoids a forcing function to find them. All legislative effort should focus on a balanced budget until it is.

- Subordinate everything else to the above decision: Once the budget is balanced, investment and operating expense decisions become a tradeoff between life, liberty, and the pursuit of happiness. Of, if we are unhappy with the throughput at each funding level, we can dig into the underlying processes. Rigorous process control becomes the forcing function for continual process improvement.

- Elevate the system’s constraints: Now the fun part – fixing processes! Are we systematically synchronizing legislative priorities? Are we max loading resources toward to the top priorities? Are we rapdily resolving issues?

- Warning! If in the previous steps a constraint has been broken, go back to step 1, but do not allow inertia to cause a system’s constraint: Over time will we surface constraints that we did not know existed. I was taught that this is like lowering a river and discovering the rocks that were hidden. They were always there disrupting the flow, but the high level of water masked them. Each constraint will take hard thought and work to break, but every iteration will truly advance our Nation.

We can view the United States as a system and all systems can be improved. We can progress beyond deficit spending and address our debt. We can advance the lives, liberty, and pursuit of happiness of all Americans within financial constraints. If we do not, we will continue to cede ownership to those willing to fund our inefficiencies until they decide to restructure.

Leave a comment